Words — Gordy Megroz

Featured Images: Keith Fearnow/Outdoor Retailer

In the fall of 2019, executives at The North Face (TNF), one of the largest outdoor gear manufacturers in the world, made a major decision: the winter Outdoor Retailer (OR) show in Denver would be the last time the company participated in OR. Several factors played into that decision, but the main component driving that determination was the timing of the winter show, which took place in January. “The trade show no longer made sense for the company,” says Scott Mellin, who, at the time served as global general manager of mountain sports for TNF. “By the time OR happened in January, we’d already met with all of the retailers and orders had already been placed, so the timing of the show just wasn’t right for us anymore.”

That wasn’t always the case. When SnowSports Industries America started its trade show in Las Vegas in 1973, it not only provided people who worked in the ski industry a nice week-long respite from the cold, it offered retailers a first look at the next season’s ski (and later snowboard) gear. At the show, retailers would place nearly all their orders for the ski clothing and equipment they’d sell the next season. As the outdoor industry grew, OR was started in 1982.

In 2017, the two shows had merged and moved to Denver, but even by then the model for the winter show was outdated. Retailers we’re often able to try gear months before the trade show, and production timelines had shifted. For factories to have time to produce clothing in time to sell for the next season, soft-good manufacturers had to have the majority of their orders taken from retailers by December. “It no longer made any sense for TNF to spend a lot of money on a booth at OR when we really weren’t getting anything out of it anymore,” says Mellin.

TNF felt the International Trade Fair for Sporting Goods and Sports Fashion show (ISPO), held in Munich in late January or early February each year since 1970, had also lost its value, and pulled their booth from that show, too. According to Mellin, skipping the two trade shows saved the company over a million dollars.

TNF was part of a small group of defectors to leave OR, which also included Arc’teryx and Burton. Then the Covid-19 pandemic happened, forcing OR to cancel its winter show. Retailers and manufacturers made up for it by attending small regional shows put on by sales reps, and many shop owners and gear company executives came to the same conclusion: they could get as much—if not more—value out of attending regional shows without spending a lot of money on airfare and booth space.

“What we’ve seen is higher-caliber regional shows are a better use of our money and time,” says Sam Beck, North America’s director of marketing for Nordica. “Having regional reps travel shorter distances to regional shows is also better for the environment.”

That said, representatives from Nordica and other companies do attend the Winter Sports Market (WSM), an invitation-only event that takes place at the same time and place as OR. The event is put on by Sports Specialists LTD (SSL) and Snowsports Merchandising Corporation (SMC), two trade groups that represent some of the biggest retailers in the industry.

Among those attending WSM is Christy Sports, which has 68 shops throughout the mountain west. “There’s a good representation of key brands and vendors at WSM, so it makes sense for us,” says Matt Gold, the CEO of Christy Sports. In fact, for Gold, WSM makes more sense than OR. “The biggest driver is cost, and the return,” he says. “The manufacturers pay less to be at WSM and can be in front of the key players in the industry so more of them are picking WSM over OR. So as long as they’re at WSM, we’ll be at WSM.”

And though the timing of WSM works for hard-good buyers and sellers who generally have longer lead time for production, it still doesn’t work for soft-goods buyers and sellers. “I’m visiting retailers in November,” says Dan Abrams, co-founder and president of Flylow. “We don’t do OR or WSM because our order deadlines have passed by then.”

Some retailers have almost entirely cut both regional and national trade shows out of their business model. “We’ve worked hard to set up brand days where we ski with product managers and actually try the gear we’re interested in buying,” says Matt Berkowitz, the brand director at Ski Monster, a Boston-based shop. “You can’t have the kinds of conversations you have on a chairlift in a trade show setting.”

But to lure winter sports manufacturers and retailers back to the show, the staff at OR is making major changes. Most importantly, they’ve moved date of the event from mid January to mid November. “We know that everyone is operating on earlier product deadlines,” says Marisa Nicholson, senior vice president of OR. “We wanted to provide the best possible platform for all parts of the industry to meet these deadlines.”

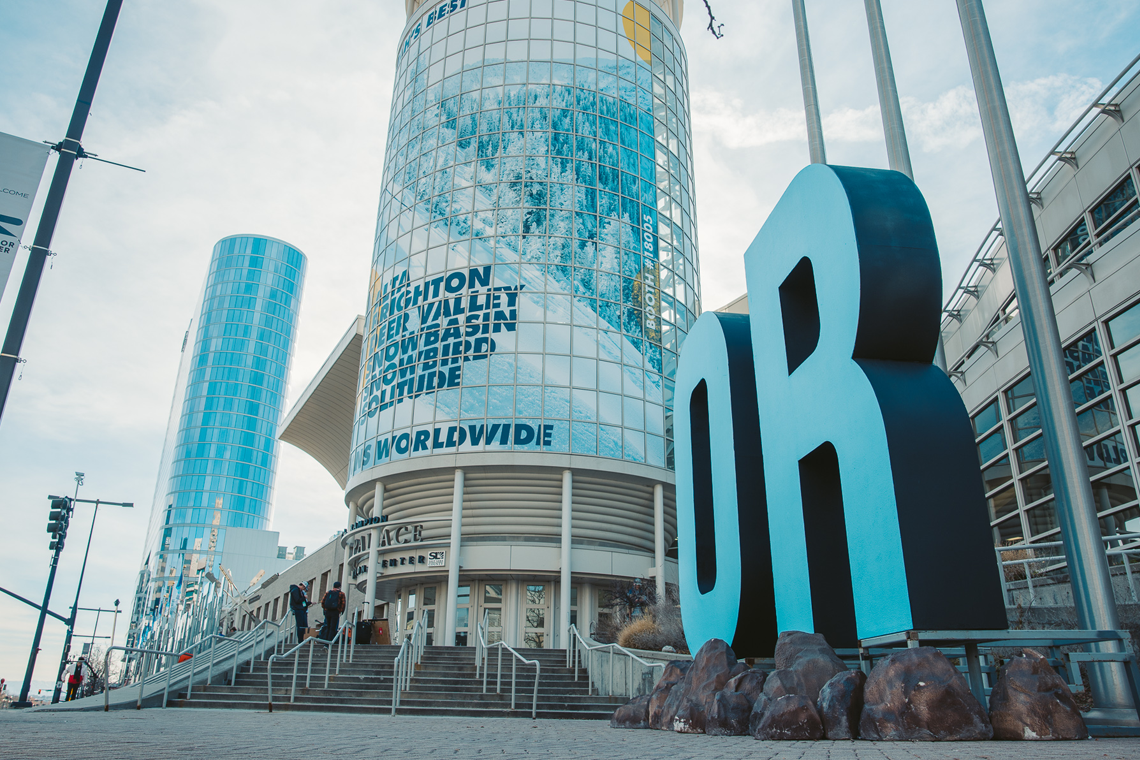

In addition, OR has moved from Denver to Salt Lake City, a decision the event managers say was based on industry feedback. One major plus, says Nicholson, is that traveling to the mountains for on-snow demos is far easier. “Even though the distance between the show and the mountains is approximately the same, the bad traffic in Colorado made getting to the mountains that much harder,” she says. Another bonus for manufacturers: Utah doesn’t require the use of union labor to construct booths, a factor that should save companies some 30 percent in costs.

OR will also feature a new consumer lifestyle event called Outdoor Adventure X, a festival setting with camping, demos, clinics, and food. “The goal of adding this consumer event is to enable consumers to directly touch, feel and use products while empowering brands and retailers to connect directly with consumers,” says Nicholson. “We really want to get back to this idea of ‘see it, try it, buy it.’”

Finally, the staff at OR is trying to tailor the show more narrowly to each individual company, providing meeting rooms to those who ask, helping them to tell their brand story, and providing education opportunities. “If your goal is to get you product and story in front of more media, we’re going to help you do that,” says Nicholson.

But will the changes be enough to reignite interest from leading brands like TNF and retailers like Christy Sports? “I hope so,” says Marty Carrigan, owner of Global Sales Guys, a company that represents a number of outdoor brands. “A national trade show is the cheapest way to see the most amount of people in the shortest amount of time. I can see everybody in one place instead of travelling all over the country. I hope that retailers realize this and come back to the show.”